Four Takeaways From Z2Data’s Obsolescence Trends in 2024 Webinar

The Most Important Electronic Component Obsolescence Trends Right Now

Key Takeaways:

- 36% of industry survey respondents believe technological innovation is the biggest driver of component obsolescence

- Market demand, technological innovation, and supply chain disruptions are the biggest drivers of obsolescence

- Obsolescence rates in 2023 fell 37% compared to the previous year.

- A little under one-third of all EOLs issued in 2023 had no PCN

From resistors to capacitors to microcontrollers, hundreds of thousands of electronic parts go obsolete every year. While the obsolescence of specific materials may affect a wide range of industries, its impact is especially acute in electronics. The reasons for this are numerous, from low demand to the rapidly-evolving pace of technological innovation, and many professionals can likely point to their own theories and experiences. But what’s really driving obsolescence in a post-pandemic world?

Z2Data conducted a study to shed light on electronic obsolescence challenges that are affecting businesses now and in the near future. Here are four key takeaways from the study that we believe will help companies better understand what’s changing in electronics and what to consider when planning their obsolescence management programs.

1. Exploring Obsolescence Perceptions in Manufacturing and Supply Chains: An Industry Survey

In March 2024, we surveyed approximately 9,000 professionals in the manufacturing and supply chain world on the topic of obsolescence. This survey was conducted to better understand how professionals are feeling the impact of obsolescence and what they perceive to be the most important drivers behind it.

Just over 31% of respondents cited ensuring compatibility and performance with replacements as one of their chief obstacles. while 26% cited forecasting obsolescence trends accurately as a recurring difficulty. Other challenges voiced by insiders included identifying alternative components (18%), securing the budget necessary for obsolescence management (8%), and never being notified of EOL changes (5%).

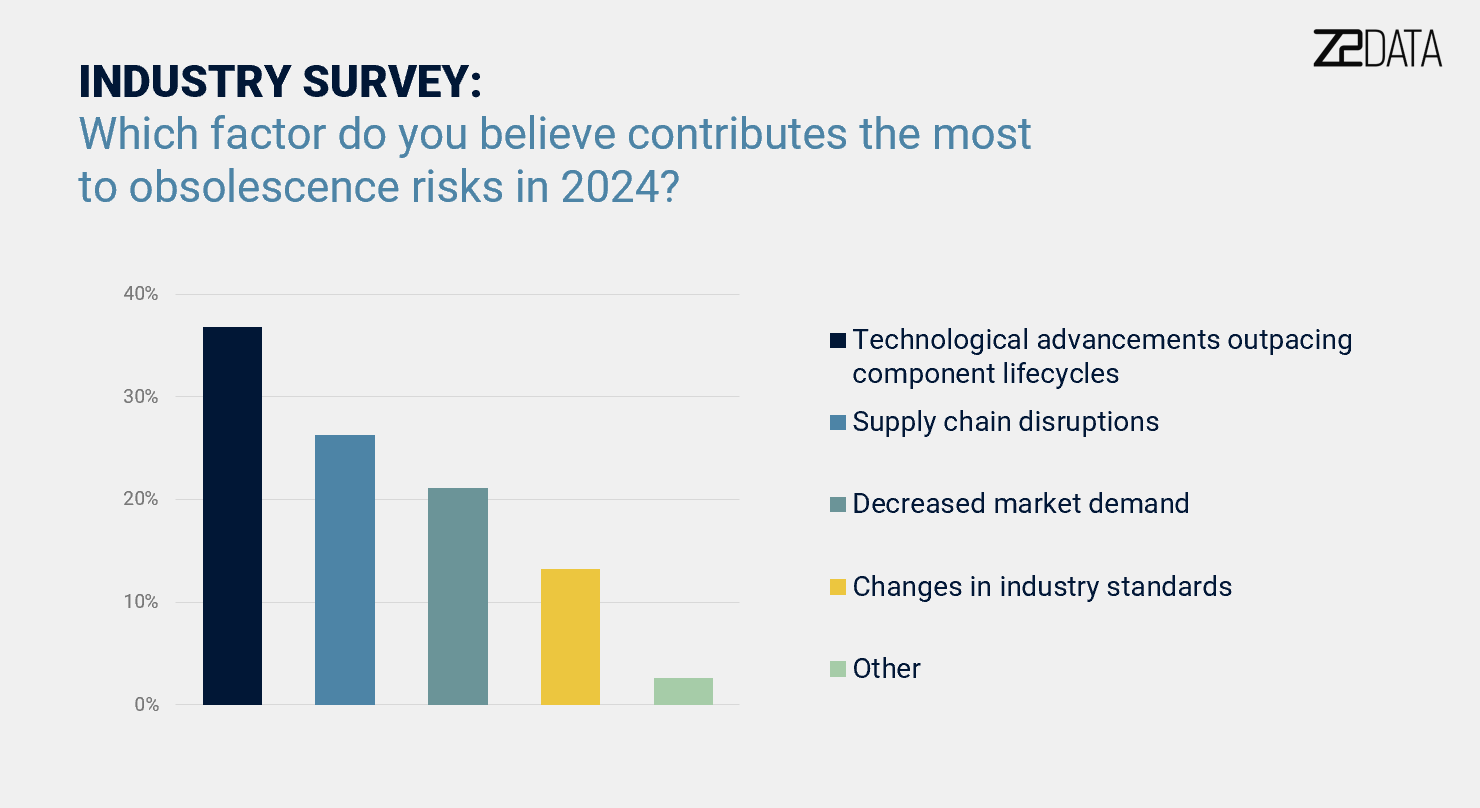

In the same survey, we also asked what factors they believed contributed the most to component obsolescence.

Over 36% of respondents cited technological advancements outpacing component lifecycles as the strongest factor in bringing about EOL. The second most popular response was supply chain disruptions (26%). Rounding out the top four were decreased market demand (21%) and changes to industry standards (13%).

When set against the actual data, the industry professionals’ responses were fairly accurate. While they correctly identified the top three reasons behind part obsolescence, they put those reasons in the wrong order. According to Z2Data’s research, low market demand—the survey’s third-most popular response—is the number one reason that parts go obsolete. A staggering 78% of all EOL events are due to low market demand as a result of shifting preferences and technological innovations emerge. Technology changes, which respondents believed was the chief factor triggering obsolescence, accounts for only 15% of all electronic parts that go obsolete. (The large discrepancy between professionals’ perception and the statistical reality here may be because technology changes often result in the most impactful obsolescence challenges for businesses.) Finally, supply chain disruptions are responsible for 7% of the obsolescence among electronic components.

2. Key Trends in Obsolescence 2021-2024: Z2Data Findings

To study obsolescence trends, Z2Data drew on its suite of databases, which collectively track over one billion parts, 150,000 worldwide suppliers, and 50,000 manufacturing sites. Our research looked at PCNs, product discontinuation notices, lifecycle status changes, and broader patterns within the industry to identify some of the most noteworthy trends happening in part obsolescence.

From a big-picture perspective, 473,910 parts went obsolete in 2023. While that might seem like a substantial figure, it actually represents a meaningful decline from the COVID-19 pandemic era. In 2021, 528,546 parts became obsolete. The following year, in 2022, that number shot up to 756,087. By contrast to the year before, obsolescence rates in 2023 are relatively modest, and 2024 projections seem to be on track for a similar figure. But while the overall number of obsolete parts year-over-year continues to decline, there's another significant aspect to consider.

3. The Hidden Challenge of EOL Notifications in Supply Chains

Of the 473,910 parts that reached EOL, 142,173, or around 30%, had no PCNs issued by manufacturers. This illustrates a somewhat pervasive lack of communication around obsolescence between suppliers and their customers. The reasons why this happens range from suppliers not wanting product changes to be major public knowledge to not having the tools or bandwidth to keep up with PCN issuances. Regardless, this discrepancy underscores a major challenge for companies that want to proactively and prepare against EOL disruptions.

In addition to the overall obsolescence numbers and their accompanying PCNs—or lack thereof—Z2Data also found that March and October historically see the highest number of EOLs.

4. Obsolescence Trends in Passive and Semiconductor Components for 2023

Taking its analysis a step further, Z2Data drilled down to look at obsolescence trends for passive and semiconductor components. Unsurprisingly, a passive components reign supreme when it comes to obsolescence by sheer numbers:

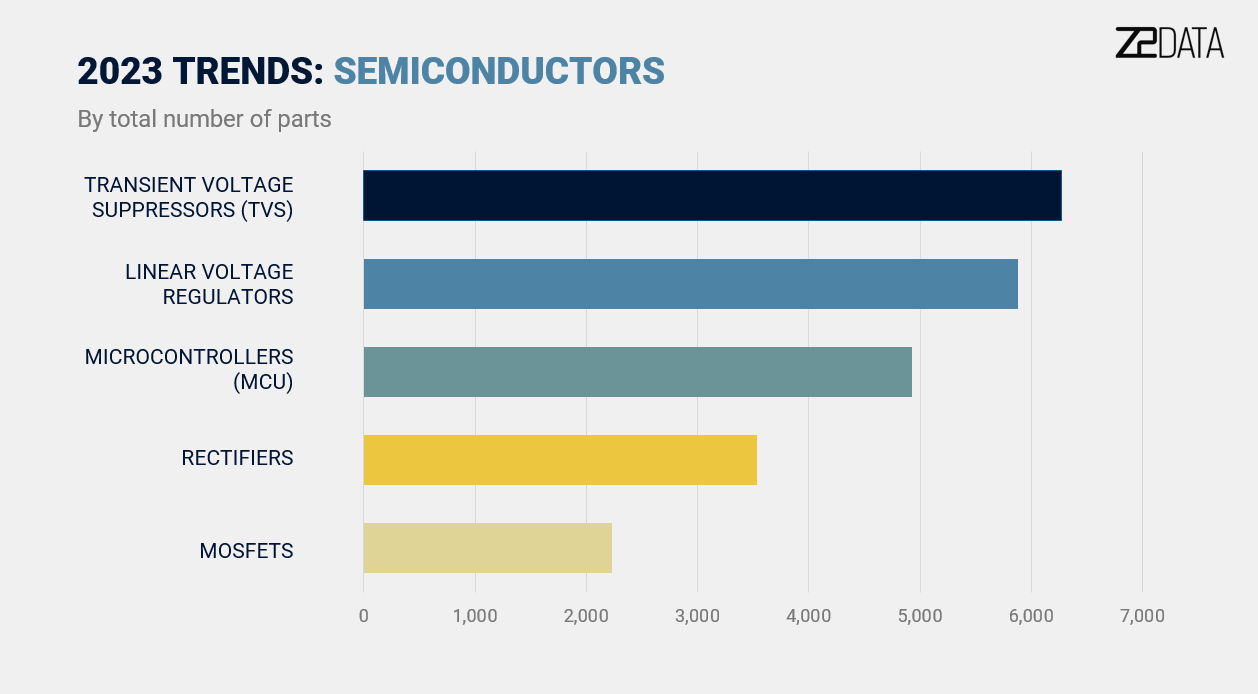

While far fewer semiconductors on the market, leading to lower overall rates of obsolescence, obsolescence in semiconductors can have much larger ramifications on a product’s lifecycle. They also contribute to higher level redesign costs. Z2Data’s analysis of semiconductor obsolescence in 2023 found the following rates of obsolescence by part type:

Navigating Component Obsolescence

As the figures from recent years cogently demonstrate, obsolescence is an intractable part of the electronics industry. Because of the careering speed of innovation, the galvanizing demands of competition, and the fragile intricacies of a globalized supply chain, hundreds of thousands of parts reach their end-of-life every year. While last year offered a welcome reprieve from the EOL onslaught of the pandemic era, challenges still remain for those who want to stay ahead of technological obsolescence and capitalize on industry trends.

Learn More With Z2Data’s Obsolescence Trends in 2024 Webinar

To learn more about component obsolescence and obsolescence management, contact Z2Data for access to a recent webinar devoted to the topic. The talk features insights into recent EOL trends, deeper dives into discontinuations within MCUs, FPGAs, and DRAM, and a discussion of obsolescence management strategies for affected businesses.

The Z2Data Solution

Z2Data’s integrated platform is a holistic data-driven supply chain risk management solution, bringing data intelligence for your engineering, sourcing, supply chain and compliance management, ESG strategist, and business leadership. Enabling intelligent business decisions so you can make rapid strategic decisions to manage and mitigate supply chain risk in a volatile global marketplace and build resiliency and sustainability into your operational DNA.

Our proprietary technology augmented with human and artificial Intelligence (Ai) fuels essential data, impactful analytics, and market insight in a flexible platform with built-in collaboration tools that integrates into your workflow.

.svg)

.jpeg)